Since the beginning of 2024, the neurointerventional market has carried out a number of centralized procurement.

On March 6, 2024, the Beijing-Tianjin-Hebei 3+N Alliance announced that it would carry out the procurement of neurointerventional coils. On March 19, 2024, the results of the centralized volume of 28 types of medical consumables in the "Beijing-Tianjin-Hebei 3+N" were announced, and the guide catheters, thrombectomy stents, and intracranial stents in the field of neurointervention were included in the centralized procurement varieties.

The procurement of 28 types of medical consumables in the "Beijing-Tianjin-Hebei 3+N" has received great attention from the industry. On the one hand, although the frequency of neurointerventional centralized procurement was high in the past, the decline was about 40%-60%, and the decline was relatively moderate. A total of 748 products were reported for the centralized procurement of 28 types of medical consumables, and 202 were to be selected, with a selection rate of only 27%.

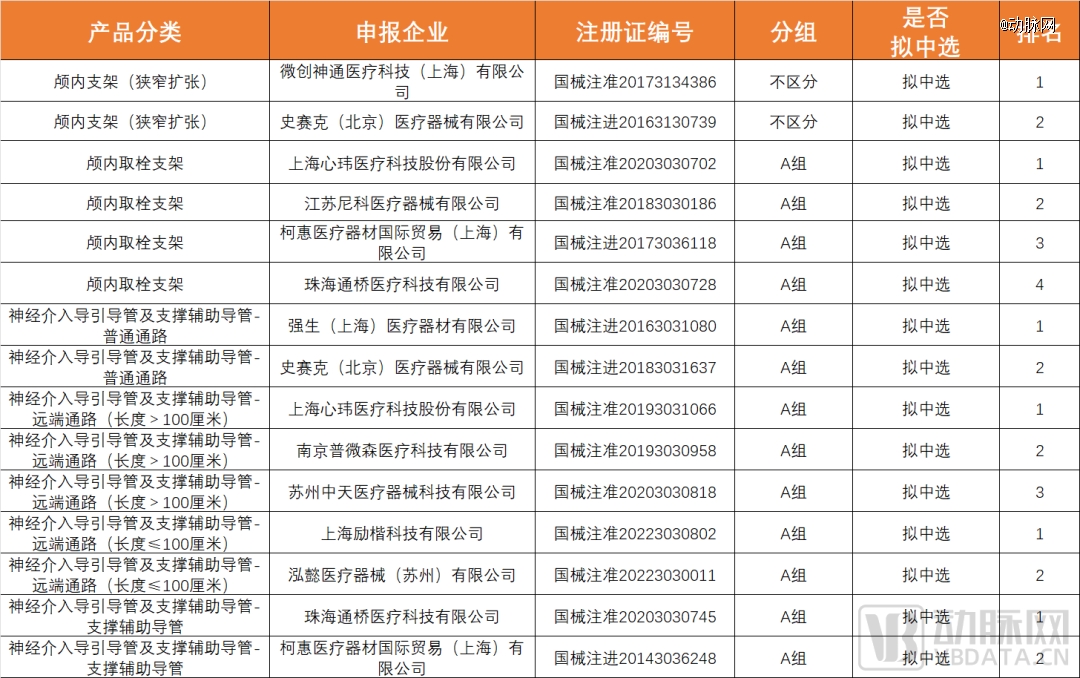

Among them, in the field of neurointervention, under the fierce competition, the minimally invasive Shentong and Stryker of intracranial stents (stenosis dilation) were selected, but Sino Medical was not selected; Intracranial thrombectomy stent group A, Xinwei Medical, Nico Medical, Kehui Medical, and Tongqiao Medical are planned to be selected, and the products of more than 20 companies have not been selected; Group A of Neurointerventional Catheters and Support Auxiliary Catheters Johnson & Johnson, Stryker, Xinwei Medical, Zhongtian Medical, Tongqiao Medical, Kehui Medical, etc., are to be selected, and the products of more than 111 companies have not been selected.

Beijing-Tianjin-Hebei 3+N28 consumables centralized procurement of neurointerventional products mainly won the bid

On the other hand, the provincial alliance accounts for about 15% of the national market size, and the enterprises that lose the standard cannot sell their products in the region for two years. If enterprises can break through in centralized procurement and increase market share, they are expected to achieve high product growth and high penetration. This centralized procurement has a significant impact on the market structure.

In the three years since the implementation of the volume procurement policy, centralized procurement has become a watershed in the development of the industry. Some enterprises did not actively participate in centralized procurement, and the market share was divided; There are also enterprises that open up markets with low market share through centralized procurement or centralized negotiation, and jump in market share through centralized procurement*.

Mastering the play of centralized procurement has become the key to winning in the market, and centralized procurement has reshaped the market pattern of different segments.

Channel products have dropped significantly,

It will drive the growth of therapeutic products

The neurointerventional products in this collection include intracranial stents (stenosis dilation), intracranial thrombectomy stents, neurointerventional catheters and support auxiliary catheters.

Judging from the results of this centralized procurement market, domestic enterprises and foreign-funded enterprises are on a par. Importers Medtronic actively participated in centralized procurement quotations, and Johnson & Johnson and MicroVention also gained a certain share in centralized procurement. From the perspective of the proportion of domestic production and imports, this centralized procurement is better than expected for the elimination of foreign-funded enterprises.

From the perspective of winning the bid for foreign investment, Stryker, an intracranial stent product, intends to be selected; The stent was remedied, Medtronic Covidia won the bid through circuit breaker remediation, and Johnson & Johnson and Stryker were out of Group B; In the highly competitive neurointerventional catheter, a product in Group A of Johnson & Johnson and Stryker's general access products is to be selected; The remote pathway was not selected by Johnson & Johnson, Medtronic, and Stryker.

Among the domestic enterprises, Sino Medical was not selected as an intracranial stent, and Giant Bio's thrombectomy stent and neurointerventional catheter and support auxiliary catheter - distal access (length > 100 cm) were not selected in group A of the two products.

The winner of the bid in this centralized procurement is Xinwei Medical, which won the bid in Group A for both intracranial thrombectomy stent and distal catheter access.

From the perspective of price reduction, in the context of rule-based price reduction, the price reduction of this centralized procurement is larger. Among them, the price of neurointerventional access auxiliary products catheters is larger.

How will the price reduction of channel products affect the market structure?

Referring to the development law of centralized procurement of many high-value consumables products in the past, the number of surgeries will rise rapidly in the short term due to the decline in prices that have reduced the burden of diseases to a certain extent, and patients' willingness to pay has increased. On the other hand, after the implementation of centralized procurement, clinicians' concepts, operating habits, and preferences are also changing, and the use rate of innovative instruments under the same surgical operation has increased significantly.

The price reduction of the centralized procurement of accessory auxiliary products is larger, which will make room for the clinical application of therapeutic products, and the market structure will usher in changes. Access products are more likely to play the role of auxiliary support in interventional surgery, and are necessary consumables for each interventional operation, and the frequency of use is much higher than that of therapeutic instruments. The guide catheter of this centralized procurement is to provide stable access for other interventional devices, so that the instruments can reach the designated parts in the blood vessels, and are used in various vascular interventional treatment processes and are widely used.

In the past, under the DRGs/DIP payment method, the unit price of auxiliary products was high, which limited the space for doctors to use innovative devices. In the past, the price of a guide catheter was about 20,000 yuan, and doctors used high-priced access guide catheters in clinical practice, and often did not use high-priced treatment products such as suction catheters and occlusion balloon catheters, and could only use off-lable guide catheters. This centralized procurement price reduction will drive different products to return to their original indications, so that doctors and patients can use better products.

After centralized procurement, the use of core therapeutic products is more beneficial, and therapeutic products usher in expansion opportunities, especially suction catheters. The release of space for the use of trans-indications in clinical use will first drive the growth of suction catheter products. In addition, the reduction in the price of access consumables will leave room for the use of more innovative devices in clinical treatment, and the penetration rate of innovative products in the field of neurointervention will be increased.

Although the frequency of centralized procurement in the neurointerventional market is relatively high, innovative products have not achieved full coverage of centralized procurement, and enterprises are expected to use centralized procurement products to drive the market of all categories.

Behind the price reduction of centralized procurement, it is also in line with the competitive situation of the neurointerventional industry. The catheter with a large price reduction is also a product with a low threshold for approval, and there are 117 registration certificates for neurointerventional access catheters in China, while there are only 17 registration certificates for suction catheters.

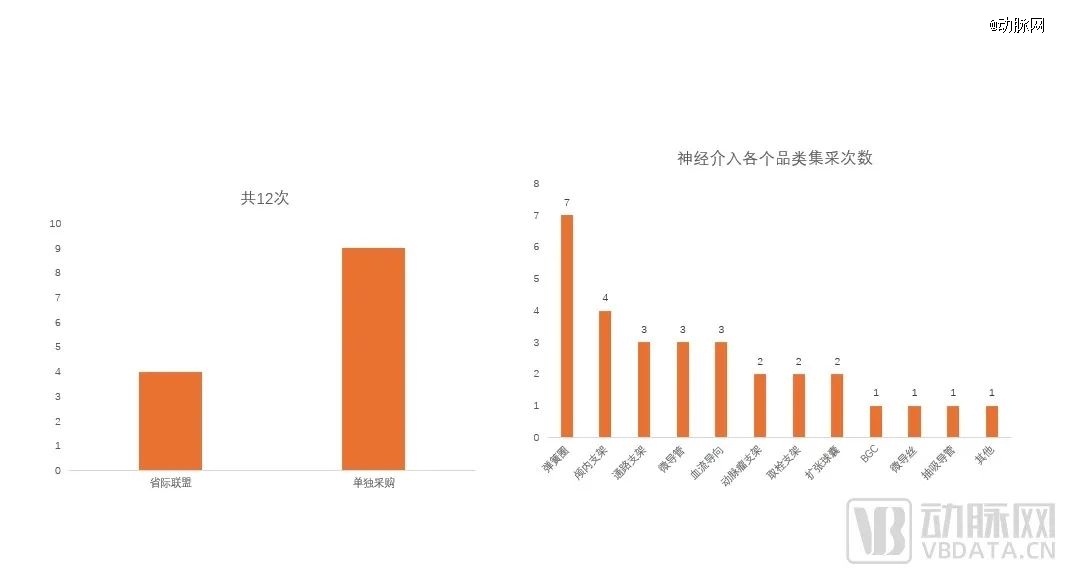

According to IQVIA statistics, intracranial stents, access catheters, and microcatheters are the neurointerventional products that have been collected the most times in addition to spring coils.

Neurointerventional centralized procurement Data source: IQVIA

This centralized procurement will become a turning point in the competition of the domestic neurological market, and the "low-threshold" auxiliary products will be transformed from marketing-driven to cost-driven, making room for "high-threshold" therapeutic products (suction catheters, intracranial stents, drug balloons and drug stents) and promoting the upgrading and transformation of the industry as a whole.

The neurointerventional market pattern has formed differentiated competition

Neurointervention is the fastest-growing segment of cardiovascular and cerebrovascular high-value consumables. By the end of 2023, China's elderly population over 60 years old has reached 290 million, and the rapid aging population and the relatively low penetration rate of cardiovascular and cerebrovascular treatment will promote the continuous growth of cardiovascular and cerebrovascular consumables. The volume of neurointerventional surgeries has reached 35-400,000 units/year, with a growth rate of more than 30%, and the market size of neurointerventional surgery has reached 20 billion yuan according to the admission price.

Data source: Neurointerventional is facing a large market of more than 20 billion yuan, and domestic enterprises are ready to go - CICC

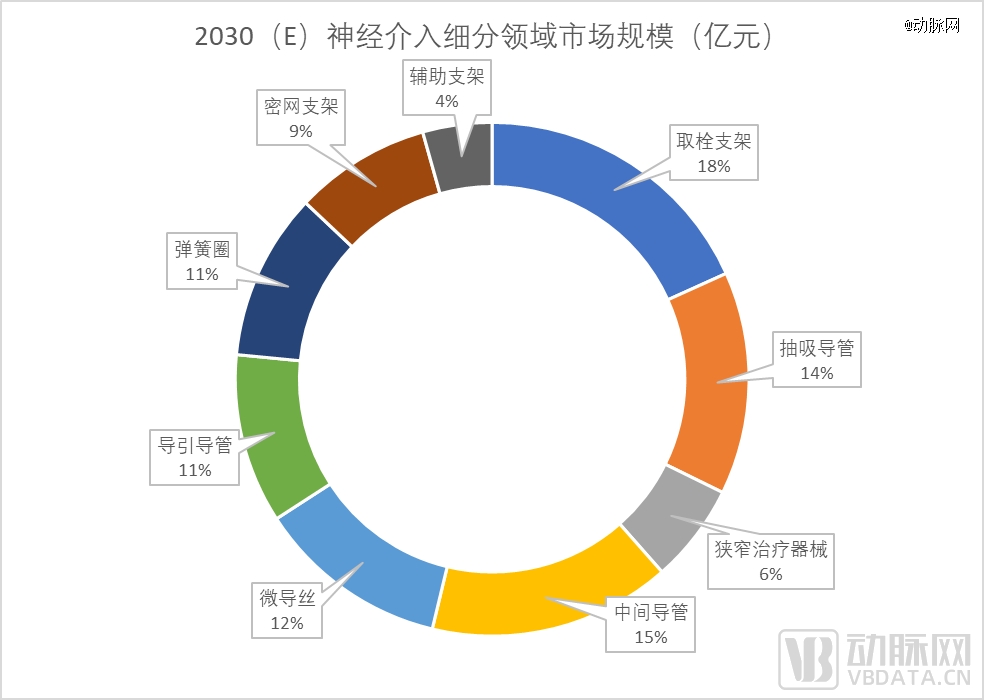

Neurointerventional high-value consumables include five categories of products: ischemic, hemorrhagic, stenosis, carotid artery, and vascular access devices. According to CICC's previous forecast, access devices will account for 38.0% of the neurointerventional market by 2030, and the market size is expected to reach 10.56 billion yuan.

From the perspective of the development of ischemia and hemorrhage, bleeding surgery has been relatively mature after 20 years of development. However, ischemic interventional surgery has only gradually developed after 2017, and the base of early ischemic surgery in the neurointerventional market is low. However, the incidence of ischemia is much higher than that of hemorrhage, and with the construction of stroke centers, the number of ischemic surgeries in China has been equal to or even surpassed by hemorrhagic surgeries.

In 2023, the domestic market share in the field of neurointervention will reach 25%, and domestic enterprises in the field of neurointervention will develop rapidly, and major domestic enterprises will establish advantages through differentiated competition.

According to the financial report data of listed companies, the increase in revenue of Xinwei Medical was mainly driven by the sales of acute ischemic stroke (AIS) thrombectomy devices and intracranial stenosis treatment devices, as well as innovative access medical devices. In the field of ischemia, there are a full line of thrombectomy stents, occlusion balloons, and suction catheters, including a combination of 4F Xinwei intracranial thrombus suction catheter and 3mm Xinwei stent MeVO, as well as Xinwei 8F super-large caliber suction catheter.

The products under development are mainly concentrated in the stenosis and bleeding markets, and the products under development include drug-eluting balloons, arterial stents, blood flow diversion devices and other products.

The growth of Guichuang Tongqiao's performance was mainly due to the intracranial support catheter, intracranial PTA balloon dilatation catheter (Rx) and intracranial thrombectomy stent. The R&D pipeline layout is mainly focused on the stenosis and hemorrhage markets, including intracranial drug-coated balloons, intracranial stents, drug-loaded self-expanding stents, blood flow diverters, and remote support catheters.

Minimally invasive brain science mainly relies on bloodflow-directed dense mesh stents, rapamycin-targeted eluting stents and coils to drive growth in the field of hemorrhage. The R&D pipeline is primarily focused on the ischemic and narrow markets.

In the first half of 2023, hemorrhage, ischemia and access products accounted for 27.3%, 39.1% and 33.1% of the segment's revenue, respectively. The R&D pipeline layout is mainly focused on the ischemic market, including suction catheters, intracranial stents, intermediate catheters, etc.

From the perspective of pipeline layout, several domestic neurointerventional companies have basically completed comprehensive coverage in the hemorrhage, ischemia, stenosis and access markets, and have also established advantages in different segments. Xinwei Medical and Guichuang Tongqiao have more advantages in the ischemia market, and Minimally Invasive Brain Science and Peijia Medical have more advantages in the bleeding market. From the perspective of R&D pipelines, major domestic enterprises are consolidating their advantages while extending to cover more markets.

The rapid development of the neurointerventional market coincides with the centralized procurement period of the domestic device market, and the life cycle of products before centralized procurement is significantly shortened compared with that before the medical reform. How to make use of the industrial characteristics of high-value consumables in centralized procurement, and how to improve performance has become the key to the overall layout.

The key point of winning centralized procurement,

How to use centralized procurement to achieve profit growth

In the domestic market, centralized procurement has become the main factor of market differentiation, and in the past four years, the industry has compressed profits, the localization process of MNC enterprises has accelerated, the domestic share has increased significantly with the help of centralized procurement, and the iteration of industry products has accelerated. Centralized procurement has profoundly rewritten the competitive landscape of the industry, and the development of enterprises has also been differentiated in this process.

In general, if you want to have an advantage in centralized procurement, you need to plan and move.

Before centralized procurement, enterprises need to use efficient channel sales to improve the penetration rate of hospitals and doctors' recognition of products, enhance brand influence, increase hospital usage, and prepare for volume procurement grouping. Only by entering Group A with a larger number of reports can we strive for a larger market share.

In centralized procurement, different regions have different characteristics, and enterprises need to deeply understand the rules of centralized procurement and accurately quote the volume. Taking the Beijing-Tianjin-Hebei 3+N centralized procurement as an example, this centralized procurement alliance tends to reduce prices by a large margin; Anhui and Fujian provinces have a higher frequency of centralized procurement, many varieties of centralized procurement, and more alliance mining participation.

In terms of centralized procurement strategy, enterprises need to have insight into the rules of centralized procurement and accurately grasp the quotation and price reduction. Judging from past cases, there are companies that have strategically lowered prices in order to gain a larger market share; There are also companies that emphasize product advantages and obtain price protection in separate groups.

After centralized procurement, in the field of high-value consumables, how to achieve product linkage to increase the sales of all categories is also the key. In general, enterprises still need to consolidate their underlying capabilities, use technological innovation platforms, lay out innovative product solutions, use manufacturing advantages to reduce costs, improve sales and marketing efficiency, and accelerate the launch of innovative products, so as to have more room to play in centralized procurement.

*Resources:

The fifth round of national procurement risks of interventional consumables and the exploration of enterprise standards and transformation strategies - IQVIA

Neurointerventional is facing a large market of more than 20 billion yuan, and domestic enterprises are ready to go-CICC

Just! The results of the centralized procurement of 28 types of consumables have been released, and more than seventy percent of the products have been eliminated...

[This article is authorized to be published by Arterial Network, a partner in the investment community, and this platform only provides information storage services. If you have any questions, please contact (editor@zero2ipo.com.cn) the investment community.